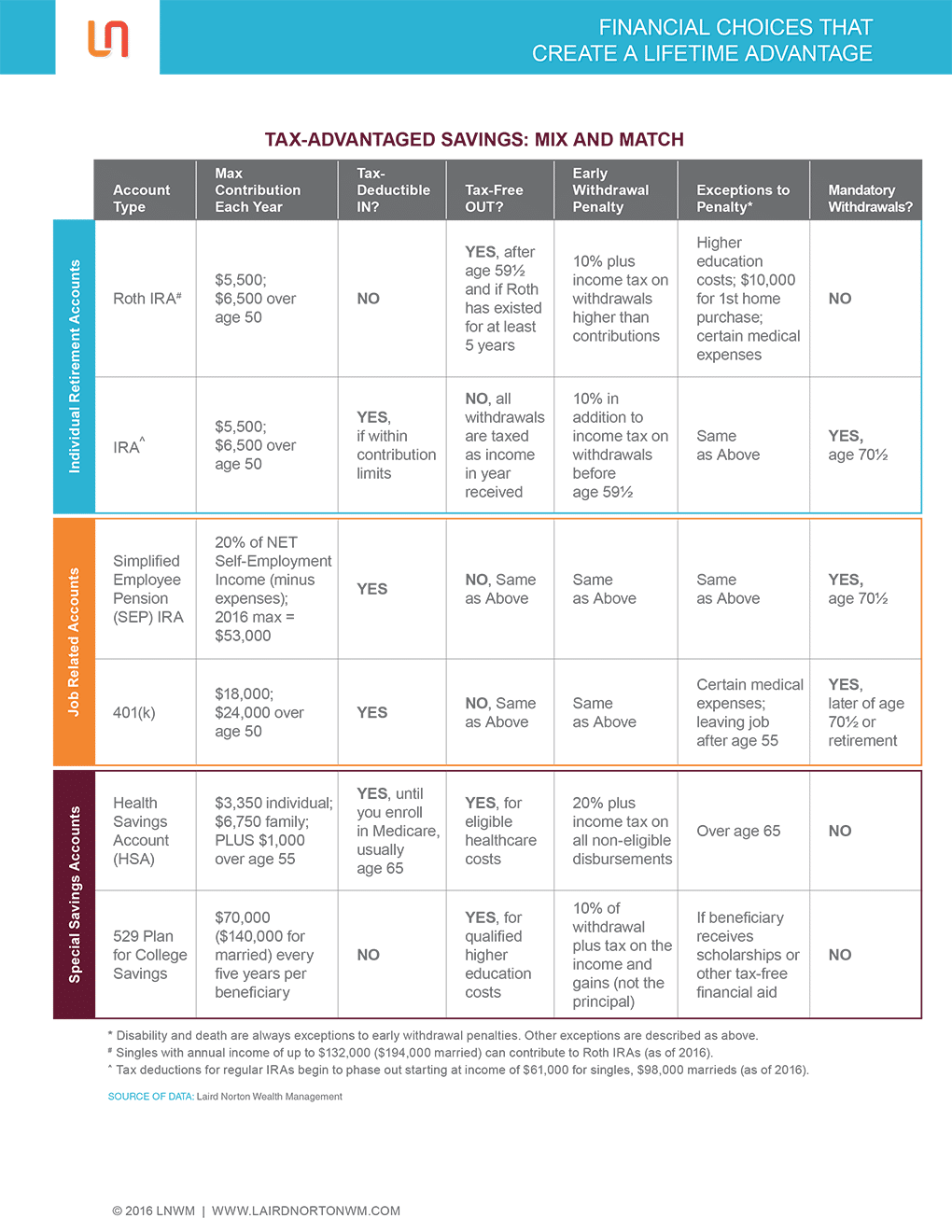

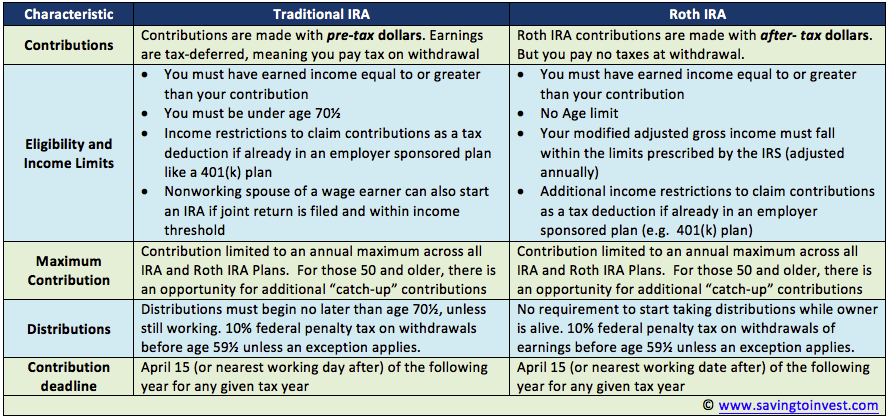

The rule continues that the dollar limits are reduced by contributions to traditional IRAs. As with traditional IRAs, there’s a 6 percent penalty on excess contributions. So assuming earnings (your own or combined with your spouse) of at least $11,000, up to $11,000 ($5,500 each) can go into the couple’s Roth IRAs. You can contribute to a Roth IRA for your spouse, subject to the income limits above. Also, the $5,500 limit is reduced for contributions to traditional IRAs though not SEP or SIMPLE IRAs.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

To make the full contribution, you must earn at least $5,500 in 2016 from personal services and have income (modified adjusted gross income or MAGI) below $117,000 if single or $184,000 on a joint return in 2016. An additional “catch-up” contribution of $1,000 (same as 2015) is allowed for people age 50 or over bringing the contribution total to $6,500 for certain taxpayers. The 2016 annual contribution limit to a Roth IRA is $5,500 (same as 2015). Funds contributed compound tax-free until distributed (standard for all tax-favored plans) and distributions are completely exempt from income tax. With a Roth IRA, there’s never an up-front deduction for contributions. There are variations from this pattern, as with 401(k)s where the exemption for salary diverted to a 401(k) takes the place of a deduction and for after-tax investments where invested capital is tax-free when distributed.

With most tax-favored retirement plans, the contribution to (i.e., investment in) the plan is deductible, the investment compounds tax-free until distributed, and distributions are taxable as received. Retirement Savings Contributions Credit.Converting From a Traditional IRA or Other Retirement Plan.

0 kommentar(er)

0 kommentar(er)